In business, understanding what turnover in business is fundamental for owners, managers, investors, and students alike. Turnover is one of the first financial metrics you learn because it reflects the total amount of money a company generates through its main activities, typically by selling goods or services, over a specific period. It’s often equated with revenue or gross income, yet many still confuse it with profit, which is a separate concept.

This article will break down what turnover means, how it’s calculated, why it matters for financial health, and how it differs from closely related terms like revenue and profit. You’ll also learn about different types of turnover, including inventory turnover, asset turnover, and staff turnover, along with practical examples, formulas, and insights into interpreting turnover for smarter strategic decisions. By the end, you’ll not only understand the term but be able to apply it confidently in business analysis and reporting.

What Is Turnover in Business?

Turnover in business refers to the total amount of money a company earns from its core operations, primarily selling goods or providing services during a defined period, such as a quarter or a year. It’s often positioned at the top line of the income statement because it represents revenues before any costs or expenses are deducted.

In many countries, especially in Europe, Asia, and the UK,“turnover” is used interchangeably with sales revenue. However, interpretations can vary by context and accounting standards. For example, in some business tax frameworks, turnover may refer to net sales after certain deductions like VAT or discounts.

Importantly:

- It does not equate to profit. Turnover tells you how much money came in, not how much was kept.

- Turnover focuses on core business activities, not income from investments or one-off events.

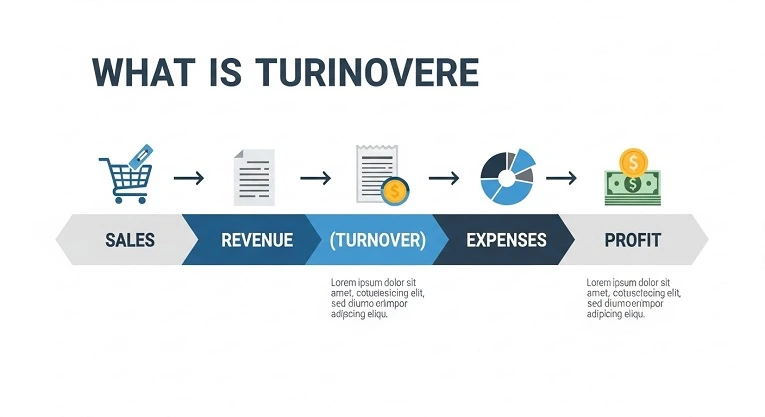

Turnover vs Revenue vs Profit

These three terms often get mixed up:

Turnover: The total income from sales of goods or services over a given period, essentially gross receipts before costs.

Revenue: Similar to turnover; however, revenue may also capture broader income streams, such as royalties or interest in some accounting frameworks.

Profit: The amount left after all expenses (costs of goods sold, operating costs, taxes, etc.) are subtracted from revenue/turnover. Profit reflects actual financial gain.

For example, if a retail store generates $500,000 in sales (turnover) but spends $400,000 on costs and expenses, its profit is $100,000, even though its turnover was significantly higher.

Understanding the difference between turnover and profit is crucial for making sound financial decisions. Turnover shows scale, while profit shows efficiency and sustainability.

How to Calculate Turnover

Calculating turnover is straightforward:

Example:

A consulting firm delivers services for 1,000 hours over the year at $100/hour.

Turnover = 1,000 × $100 = $100,000

Some businesses distinguish between:

- Gross Turnover: All income before deductions (discounts, returns, VAT)

- Net Turnover: Income after those deductions

Knowing whether you’re using gross or net figures is critical for accurate benchmarking and reporting.

Types of Turnover Metrics

Inventory Turnover

Inventory turnover measures how many times inventory is sold and replaced in a period. It’s critical for retail, manufacturing, and distribution businesses.

Higher turnover generally means efficient inventory management.

Accounts Receivable Turnover

This metric shows how effectively a company collects payments from customers on credit.

High turnover indicates strong collections; low turnover signals slow payment cycles.

Asset Turnover

The asset turnover ratio compares sales revenue to total assets, revealing how well a business uses its assets to generate sales.

Staff Turnover

Outside of financial metrics, “turnover” can also describe the rate at which employees leave and are replaced, a key HR performance indicator.

Why Turnover Matters

Turnover serves many strategic purposes:

- Performance Indicator: Reflects sales effectiveness and market demand.

- Investor Insight: High turnover may signal strong business viability.

- Valuation Tool: Turnover figures influence company valuation in sales or funding.

- Benchmarking: Helps compare efficiency across peers.

Turnover Ratios & Benchmarking

Using turnover as a baseline, companies calculate ratios like inventory turnover, asset turnover, and working capital turnover to evaluate efficiency and operational health against industry standards.

Common Misconceptions

- Turnover equals profit

- Turnover includes non-core income (like interest), usually

- Turnover is the same globally. Definitions vary by region and accounting standards.

Turnover in Different Industries

Retail and consumer businesses often have high turnover due to frequent sales, while capital-intensive industries may have lower turnover but higher profit margins. Industry context matters when interpreting turnover figures.

Turnover and Business Strategy

The Turnover isn’t just a reporting number; it guides pricing strategies, marketing spend, expansion plans, and performance incentives.

Turnover Examples

- Small Café: Daily sales of $1,000 → Annual turnover: $365,000

- Software Company: Subscription licenses & services → Turnover depends on recurring and one-off sales.

Improving Turnover Performance

Strategies include:

- Boosting sales through promotions or new markets

- Improving collections to speed up receivables

- Enhancing inventory management

FAQs

What is business turnover?

Turnover is the total money a business makes from core operations, typically sales, over a period.

Is turnover the same as revenue?

In many regions, yes, turnover is another term for revenue or gross income.

How do I calculate turnover?

Add all sales income over a specific timeframe.

Does high turnover mean high profit?

Not necessarily, profit also depends on costs.

What is inventory turnover?

It’s a ratio that shows how often inventory is sold and replaced.

Conclusion

Understanding what is turnover in business is is crucial for evaluating how well a company performs in its core operations. Turnover lays the foundation for deeper analysis, including profitability, efficiency, and strategic direction. By mastering turnover concepts and ratios, you empower better business decisions and clearer communication with investors, stakeholders, and teams. Always remember: while a strong turnover is promising, it must be balanced with cost control and smart operations to turn that top-line success into sustainable profitability